Edvancer's Knowledge Hub

Growing demand for data scientists in the insurance sector

Since the past decade, every company in the reckoning has been watching with rapt attention to what is surely a game-changing asset for their industry – data. Data scientists have mathematical, statistical, data-mining and programming knowledge which they put to good use to derive the maximum out of a company’s data.

Technology is advancing at a rapid pace and is getting increasingly complex and with sophisticated technology, the requirement arises for a more advanced skill-set to exploit the technology to its full capability. This is the reason why there is growing demand for data scientists within the insurance industry, as with most others.

Insurance is a complex industry to understand, and is becoming increasingly data-centric with time. Insurance basically is a service which is required to be customized and personalized based on various factors, and deep-learning and machine-learning assist with this.

Data science and big data are fairly new disciplines, with many people queuing up to hone these skills in anticipation for the future. In all probability, a company would hunt for data scientists and train them to adapt to the requirements of the insurance industry.

Data has always been central to what insurers do. For instance, traditional actuarial underwriting deals with the analysis of data to get better insights into risk-based pricing.

What has changed is that data has burgeoned in volume, quality and accessibility, and we now can also combine and analyze multiple data sources;, something that is giving insurers a great deal of food for thought. The insurance sector needs data scientists for a number of reasons, including applying machine-learning and predicting customer patterns.

To give you an idea, the combination of data sources in the insurance industry could include the merging of a calorie-tracking app, fitness app, diabetes app, and a wellness and mindfulness app, with the results being used to create better customer insights for use by both, the company and the consumer. Data science can also help insurers provide better advice to customers by combining data sources.

Data scientists have always been around in the insurance industry; as ‘actuaries’ who have successfully implemented tried-and-tested models for many decades. With the advent of big data, artificial intelligence and machine-learning, people are realizing that insurance firms have the ability to combine data from multiple sources of their own, as well as data from external agencies, and target niches or specific cases better, and get better insights, be it for pricing or countering fraud.

Further any cases of fraud detected and eliminated at any point of time helps to drive prices down in the market. The number of innovative insurance claim frauds has put insurers in a quandary. Companies want to simplify the claims process and eliminate the trust deficit faced by insurers.

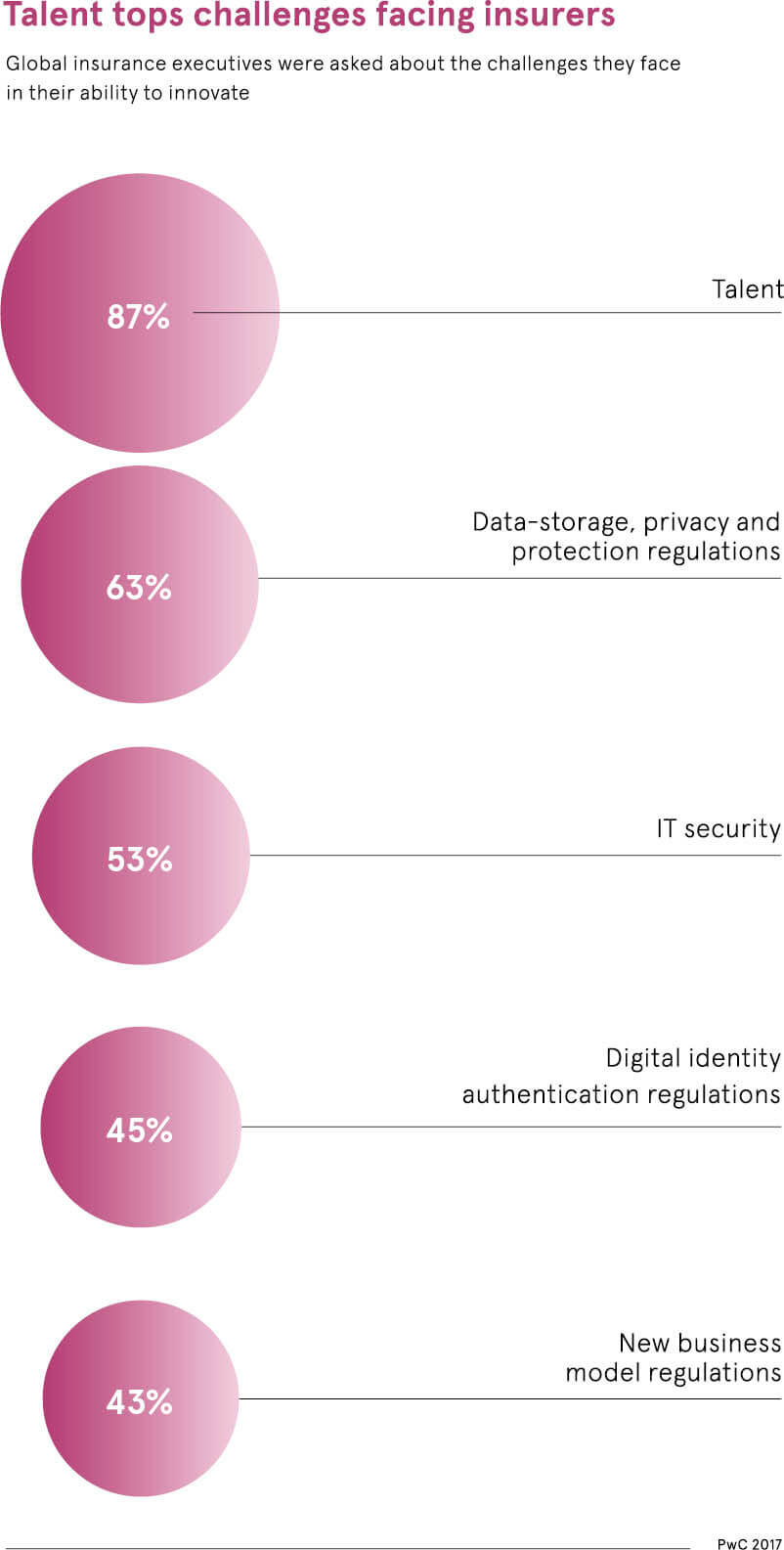

It is extremely difficult to find the rare breed of data scientists who also possess the domain knowledge of an underwriter. These highly sought-after hybrid data scientist-underwriters are so rare that they are referred to in recruitment as “purple squirrels”. A recent finding by PwC in 2017, as depicted in the chart reveals that the biggest challenge faced by global insurance executives was the lack of a talent pool.

An easy way of creating a data scientist is equipping the insurance experts with the data science tools. Actuaries and their IT project partners are proficient in Mathematics and already possess core analysis skills – knowledge of regression and classification methods, probabilistic modeling, matrix algebra, and parameter estimation on the numerical side, as also data format interfaces, reporting and price delivery on the IT side.

While a few insurers might be tempted to go in for off-the-shelf products or algorithms they can deploy that would do away with the need for data scientists, they need to realize that algorithms need to be monitored and policed to ensure there are no in-built biases. There have been some instances of un-policed algorithms having in-built biases against certain minority groups when pricing car and home insurance policies, which can damage the reputation of the insurer. Enterprises should be able to trust the outputs of their algorithms and have the capability to use the data effectively, if at all this technology is to succeed.

Data scientists who have honed their skills and developed effective algorithms have very high earning potential. Data scientists can command quite high salaries within the Insurance sector because they are aware of the criticality of their roles and that they have a direct impact on profitability for their companies. Depending on seniority, responsibilities and technical knowledge, a data scientist can expect to draw a salary of up to 15 lakh INR in the insurance sector.

However, a data scientist cum insurance underwriter would earn the highest dream pay package. With such an exceptionally high demand for these skills, those possessing the required skills can quote their price.

It makes sense to have an in-house data scientist, or ideally a data scientist-underwriter, to head and direct a team.

The sooner companies adapt and ensure data science is a part of their organization, the more competitive they will be in the forthcoming years. Meanwhile, the hunt for purple squirrels is on.

An easy way of creating a data scientist is equipping the insurance experts with the data science tools. Actuaries and their IT project partners are proficient in Mathematics and already possess core analysis skills – knowledge of regression and classification methods, probabilistic modeling, matrix algebra, and parameter estimation on the numerical side, as also data format interfaces, reporting and price delivery on the IT side.

While a few insurers might be tempted to go in for off-the-shelf products or algorithms they can deploy that would do away with the need for data scientists, they need to realize that algorithms need to be monitored and policed to ensure there are no in-built biases. There have been some instances of un-policed algorithms having in-built biases against certain minority groups when pricing car and home insurance policies, which can damage the reputation of the insurer. Enterprises should be able to trust the outputs of their algorithms and have the capability to use the data effectively, if at all this technology is to succeed.

Data scientists who have honed their skills and developed effective algorithms have very high earning potential. Data scientists can command quite high salaries within the Insurance sector because they are aware of the criticality of their roles and that they have a direct impact on profitability for their companies. Depending on seniority, responsibilities and technical knowledge, a data scientist can expect to draw a salary of up to 15 lakh INR in the insurance sector.

However, a data scientist cum insurance underwriter would earn the highest dream pay package. With such an exceptionally high demand for these skills, those possessing the required skills can quote their price.

It makes sense to have an in-house data scientist, or ideally a data scientist-underwriter, to head and direct a team.

The sooner companies adapt and ensure data science is a part of their organization, the more competitive they will be in the forthcoming years. Meanwhile, the hunt for purple squirrels is on.

Share this on

Follow us on

An easy way of creating a data scientist is equipping the insurance experts with the data science tools. Actuaries and their IT project partners are proficient in Mathematics and already possess core analysis skills – knowledge of regression and classification methods, probabilistic modeling, matrix algebra, and parameter estimation on the numerical side, as also data format interfaces, reporting and price delivery on the IT side.

While a few insurers might be tempted to go in for off-the-shelf products or algorithms they can deploy that would do away with the need for data scientists, they need to realize that algorithms need to be monitored and policed to ensure there are no in-built biases. There have been some instances of un-policed algorithms having in-built biases against certain minority groups when pricing car and home insurance policies, which can damage the reputation of the insurer. Enterprises should be able to trust the outputs of their algorithms and have the capability to use the data effectively, if at all this technology is to succeed.

Data scientists who have honed their skills and developed effective algorithms have very high earning potential. Data scientists can command quite high salaries within the Insurance sector because they are aware of the criticality of their roles and that they have a direct impact on profitability for their companies. Depending on seniority, responsibilities and technical knowledge, a data scientist can expect to draw a salary of up to 15 lakh INR in the insurance sector.

However, a data scientist cum insurance underwriter would earn the highest dream pay package. With such an exceptionally high demand for these skills, those possessing the required skills can quote their price.

It makes sense to have an in-house data scientist, or ideally a data scientist-underwriter, to head and direct a team.

The sooner companies adapt and ensure data science is a part of their organization, the more competitive they will be in the forthcoming years. Meanwhile, the hunt for purple squirrels is on.

An easy way of creating a data scientist is equipping the insurance experts with the data science tools. Actuaries and their IT project partners are proficient in Mathematics and already possess core analysis skills – knowledge of regression and classification methods, probabilistic modeling, matrix algebra, and parameter estimation on the numerical side, as also data format interfaces, reporting and price delivery on the IT side.

While a few insurers might be tempted to go in for off-the-shelf products or algorithms they can deploy that would do away with the need for data scientists, they need to realize that algorithms need to be monitored and policed to ensure there are no in-built biases. There have been some instances of un-policed algorithms having in-built biases against certain minority groups when pricing car and home insurance policies, which can damage the reputation of the insurer. Enterprises should be able to trust the outputs of their algorithms and have the capability to use the data effectively, if at all this technology is to succeed.

Data scientists who have honed their skills and developed effective algorithms have very high earning potential. Data scientists can command quite high salaries within the Insurance sector because they are aware of the criticality of their roles and that they have a direct impact on profitability for their companies. Depending on seniority, responsibilities and technical knowledge, a data scientist can expect to draw a salary of up to 15 lakh INR in the insurance sector.

However, a data scientist cum insurance underwriter would earn the highest dream pay package. With such an exceptionally high demand for these skills, those possessing the required skills can quote their price.

It makes sense to have an in-house data scientist, or ideally a data scientist-underwriter, to head and direct a team.

The sooner companies adapt and ensure data science is a part of their organization, the more competitive they will be in the forthcoming years. Meanwhile, the hunt for purple squirrels is on.

Manu Jeevan

Manu Jeevan is a self-taught data scientist and loves to explain data science concepts in simple terms. You can connect with him on LinkedIn, or email him at manu@bigdataexaminer.com.

Latest posts by Manu Jeevan (see all)

- Python IDEs for Data Science: Top 5 - January 19, 2019

- The 5 exciting machine learning, data science and big data trends for 2019 - January 19, 2019

- A/B Testing Made Simple – Part 2 - October 30, 2018

Follow us on

Free Data Science & AI Starter Course